Introduction

What Is Extrusion Machinery?

Extrusion machinery processes raw materials—plastics, metals, composites—through a die to create products such as pipes, films, profiles, and cables with continuous cross-sections. These systems range from single-screw for simple profiles to twin-screw machines offering better mixing, higher throughput, and versatility.

Relevance in the MEA Region

In the Middle East & Africa (MEA), extrusion is foundational to construction, packaging, automotive, and food industries. Governments and private sectors are investing in local production and processing capabilities, making extrusion essential to manufacturing strategies and economic diversification.

Market Overview

Market Size and Growth Projections

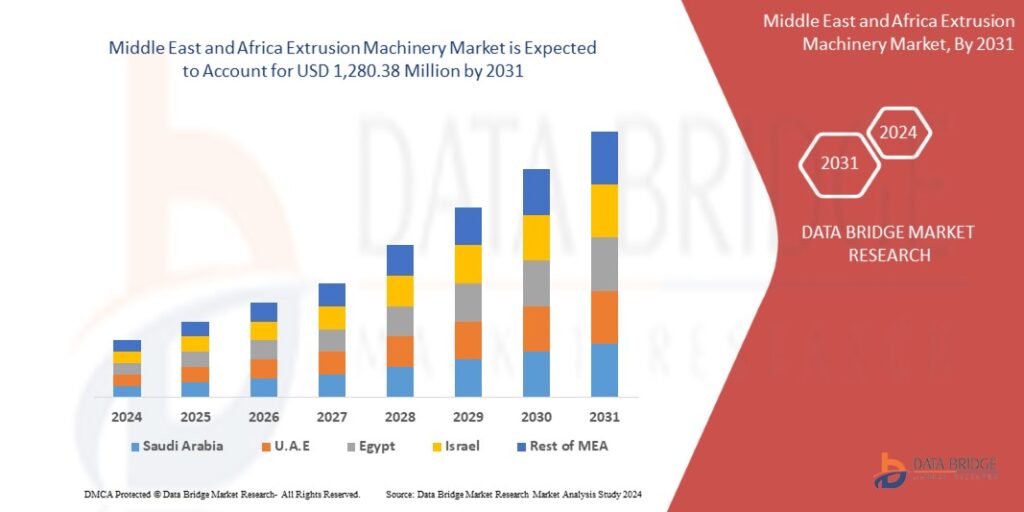

The MEA extrusion machinery market was estimated at approximately USD 507 million in 2023, with projections reaching USD 630 million by 2030, reflecting a CAGR of around 3.2% between 2024 and 2030 Another report places the broader extrusion machinery market—including metal and plastic—at USD 962 million in 2023, growing to about USD 1.28 billion by 2031 (CAGR ~3.7%) .

Key Sectors and Trends

The plastics extrusion segment remains dominant, with construction and packaging as primary end-use areas Growth is also supported by a rising food processing sector (snacks, cereals) and pharmaceutical packaging, prompting demand for precision, hygiene, and flexibility in extrusion operations.

Market Segmentation

By Extrusion Type & Process Output

-

Direct vs. indirect extrusion

-

Single-screw for pipes, profiles; twin-screw for compounds, complex blends

-

Process outputs include solid, hollow, semi-hollow profiles used widely across industries

By Material & Application

-

Structural plastic profiles in construction

-

Films and sheets in packaging

-

Medical tubing and blister packs in healthcare

-

Automotive parts and cables for automotive and electronics sectors

By Country

-

South Africa leads in adoption and growth, due to infrastructure and food processing

-

Saudi Arabia and the GCC see strong demand tied to industrial and construction projects

-

Egypt benefits from rapid construction investment supported by government programs

-

Rest of MEA includes emerging markets in North and West Africa where growth is building

Regional Analysis

South Africa

South Africa is the fastest-growing country market in the region, with rising demands from food and packaging sectors . Robust industrial base and local manufacturing drive steady investments in new extrusion capacity.

Saudi Arabia & GCC

With diversified economies and major infrastructure spending (e.g., NEOM, Riyadh Metro), extrusion investments are intensifying. In 2023, Saudi Arabia’s market was USD 134 million, forecast to reach USD 168 million by 2030 at ~3.3% CAGR

Egypt

Supported by over USD 55 billion in construction activity and growing chemical, packaging, and healthcare sectors, Egypt offers significant extrusion expansion .

Rest of MEA

Other MEA countries—from UAE to Nigeria—are expanding capacity in niche areas like water-based films, pipes, and industrial profiles, driven by urbanization and diversification

Market Drivers

Construction and Infrastructure Surge

Infrastructure projects—housing, roads, energy—are a major driver. Extruded plastic piping, aluminum profiles, and insulation components are key elements in modern construction

Food Processing and Packaging Expansion

Demand for snacks, ready-meals, and pharmaceuticals fuels extrusion demand. Up to 20% of extruded output in the region is linked to food and beverage packaging .

Industrialization & Automotive Sector

Lightweight plastic and aluminum parts are gaining ground in automotive. Extrusion—benefiting from twin-screw technologies—delivers higher performance parts .

Market Challenges

High Capital Investment

Extrusion lines, especially twin-screw or specialized machines, require substantial investment—barrier for SMEs and some emerging markets .

Skills Shortage

Operating and maintaining advanced extrusion equipment demands skilled technicians—a gap across MEA that constrains adoption

Environmental & Regulatory Pressures

Plastic pollution concerns, energy use, and emissions regulations are prompting stricter controls. Manufacturers may need new machine capabilities or retrofits .

Technological Trends & Innovations

Twin‑Screw & Energy‑Efficient Machining

Twin-screw extruders offer superior thorough mixing and polymer flexibility—critical for advanced materials. Energy-efficient designs are becoming standard, with lower consumption and higher throughput .

Additive Manufacturing Integration

The integration of 3D printing with extrusion—especially for prototyping and hybrid applications—is emerging in the MEA market, particularly in industrial sectors .

Smart / Industry 4.0 Solutions

Factories are deploying software for real-time monitoring, predictive maintenance, and quality control—moving extrusion into the realm of smart manufacturing .

Competitive Landscape

Key Players

Global leaders such as Milacron India, Japan Steel Works, KraussMaffei, Wenger, Davis‑Standard, and Graham Engineering are active across MEA, offering packages suited to plastics and metal extrusion Local manufacturers, including Al Ghurair Group (aluminum extrusions) and INDEVCO Group, operate regional plants and models

SWOT Analysis

| Strengths | Weaknesses |

|---|---|

| Aligned with regional industrial and construction megatrends | Traditional machines vs advanced global technologies |

| Twin-screw and energy-efficient machines boosting productivity | High CAPEX, small scale operators struggle to access advanced tech |

| Diverse growth in packaging, automotive, and food processing | Skill shortage in machine operation and maintenance |

| Opportunities | Threats |

|---|---|

| Increasing demand in plastics, metal, composite materials | Regulatory risks around plastic use and emissions |

| Integration of digital technologies in smart factories | Raw material price volatility and energy cost rise |

| Local manufacturing and import substitution projects | Global economic slowdown, trade disruptions, sanctions |

Future Opportunities

-

Energy-Efficient Systems: Growing demand for green machinery will open business for energy-saving equipment.

-

Localized Manufacturing: Governments’ import-reduction pushes will lure extrusion OEMs to open regional plants.

-

Agritech & Healthcare: Irrigation pipes and pharma packaging present niche high-margin opportunities.

-

Advanced Materials: Demand for carbon-filled and fire-retardant profiles in industrial segments will grow.

-

Smart Retrofits & IoT: Older plants will retrofit with sensors and analytics, extending their lifespan and performance.

Conclusion

The Middle East & Africa extrusion machinery market is on course for steady expansion, reaching beyond USD 600 million by 2030. Growth hinges on government-driven infrastructure development, expanding food and packaging sectors, and industrial diversification.

Challenges remain—such as high initial costs, workforce limitations, and environmental regulations—but they also define the roadmap for future transformation. By embracing energy-efficient technologies, smart factory systems, advanced materials, and regional production, the sector can tap into the region’s full potential.

Industry players that invest in local partnerships, technical training, and product innovation will lead the MEA market into a resilient, adaptive, and sustainable future—solidifying extrusion machinery’s role as a pillar of industrial growth.

Get More Details : https://www.databridgemarketresearch.com/reports/middle-east-and-africa-extrusion-machinery-market

Get More Reports :

https://www.databridgemarketresearch.com/reports/europe-sarcopenia-treatment-market

https://www.databridgemarketresearch.com/reports/global-cholera-vaccines-market

https://www.databridgemarketresearch.com/reports/global-granola-bars-market

https://www.databridgemarketresearch.com/reports/europe-optical-power-meter-market

https://www.databridgemarketresearch.com/reports/global-iot-in-elevators-market