Drift is thrilled to introduce you to a brand new collection, “Price Action Concepts 101”. This series objectives to equip aspiring price movement buyers with the brand new principles, permitting buyers to begin imposing these strategies on Drift. To kick off the series, permit’s delve into the arena of Fair Value Gaps (FVGs), a extensively-used idea in price motion trading.

Lesson 1: Fair Value Gap (FVG)

The Fair Value Gap (FVG) is a extensively applied idea among fee motion traders nowadays as it aids inside the improvement of buying and selling strategies and selection-making inside the markets. Though its starting place is unsure, it’s miles believed to have been popularized by means of the Inner Circle Trader.

What Is A Fair Value Gap?

Before diving into the realistic use of the Fair Value Gap in buying and selling, it’s critical to have a clean understanding of what it’s far and a way to identify it to your charts. The Fair Value Gap, or FVG, is a broadly applied tool amongst charge motion investors to hit upon marketplace inefficiencies or imbalances. Sometimes you will even see them labeled as inefficiencies with the aid of other investors. These imbalances get up whilst buying or selling pressure is full-size, resulting in a huge upward or downward flow, leaving at the back of an imbalance within the market.

The idea in the back of FVGs is that the market will ultimately come returned to those inefficiencies within the marketplace before continuing in the identical direction because the initial impulsive pass. FVGs are critical considering the fact that traders can achieve an facet in the market. Price motion investors also can use those imbalances as entry or go out factors in the market.

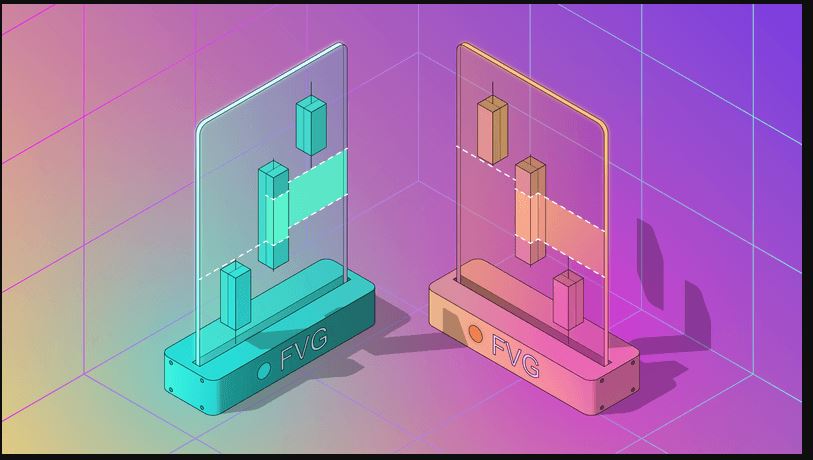

For a FVG to broaden, there ought to be a hard and fast of 3 candles characterised by using heavy shopping for or promoting in the same path. When there may be a big move in either course, an opening can be formed among the primary candle’s wick and the wick of the ultimate candle, as illustrated within the figures below.

The example underneath does no longer depict a Fair Value Gap, because the previous candle’s excessive level has counterbalanced the low degree of the 1/3 candle. This price movement is considered to be balanced.

How To Use FVGs To Trade Price Action?

Fair Value Gaps (FVGs) may be discovered on all timeframes and there are various buying and selling techniques that may be applied using them. In this case, permit’s cognizance on using FVGs for trend continuation after a significant impulsive pass. As previously stated, you may count on the charge to go back to these FVGs before continuing in the equal direction as the impulse pass. Traders can take advantage of this with the aid of looking ahead to the price to reach the FVG location of interest after which entering a alternate, focused on trend continuation.

For instance, let’s take a look at the Solana chart in the course of its big run in January 2023. As visible at the left side of the chart, a FVG turned into formed and charge consolidated over numerous days before it lower back to test the FVG. Traders may have used this FVG as a key stage of interest for access into a long trade on SOL and rode it for further fashion continuation.

How Can I Find FVGs On My Own?

Identifying Fair Value Gaps (FVGs) within the markets may be pretty honest because of their big impulse movements. However, if you need more assistance, there are numerous loose signs available on TradingView that can useful resource in detecting these imbalances. Simply type in “FVG” or “Imbalance” within the seek bar, and any of the top options need to be able to help you in figuring out those imbalances within the market.