Saudi Arabia Chocolate Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

Market Overview

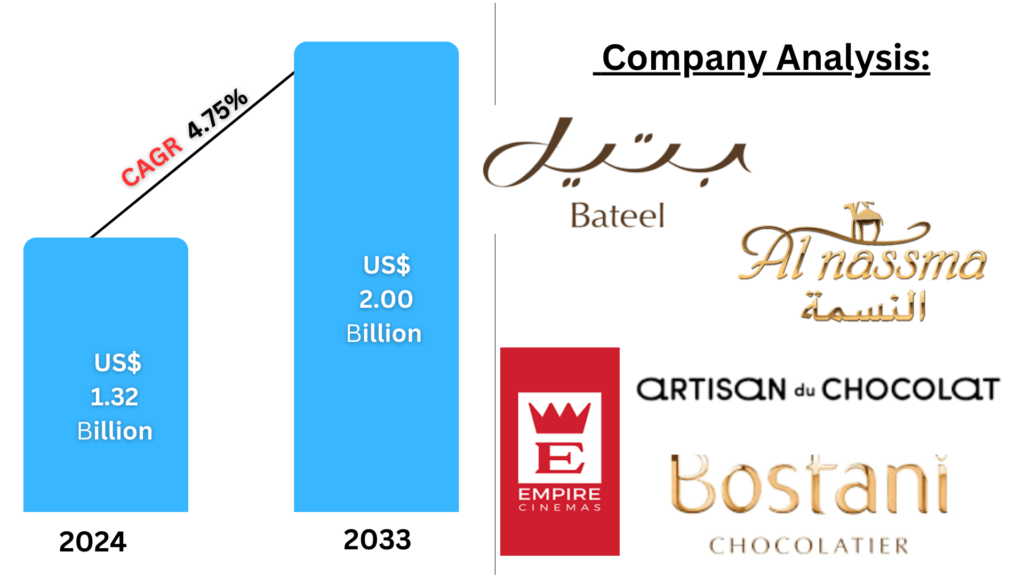

The Saudi Arabian chocolate market was valued at US$ 1.32 billion in 2024, with projections to grow at a CAGR of 4.75% from 2025 to 2033, reaching US$ 2.00 billion by 2033. The key drivers of this growth include increasing demand for premium chocolates, rising disposable incomes, and the growing trend of chocolate as a gift and indulgence option during festivals and celebrations.

Market Segmentation

The Saudi Arabia chocolate market is analyzed by:

- Type

- Dark Chocolate

- Milk/White Chocolate

- Ingredients

- Cocoa Beans

- Cocoa Butter

- Sweeteners

- Chocolate Liquor

- Others

- Distribution Channel

- Hypermarkets/Supermarkets

- Convenience Stores

- Online Retail Stores

- Other Distribution Channels

- Region

- Western

- Northern & Central

- Eastern

- Southern

Market Trends and Dynamics

Demand Growth Factors

- Consumer Preferences: There’s an increasing preference for premium chocolates, especially those with higher cocoa content. Consumers are also seeking healthier, more indulgent options, such as dark chocolate, which is considered both a treat and a health-conscious alternative due to its antioxidant properties.

- Cultural Influence: Cultural festivals, especially Eid and Ramadan, see a surge in chocolate consumption as gifting plays a significant role in Saudi traditions. This period also witnesses increased demand for luxury chocolate brands.

- Tourism Boost: With a thriving tourism sector, especially due to religious pilgrimages like Hajj and Umrah, the demand for chocolates as mementos and gifts has significantly increased, providing opportunities for local and international chocolate brands.

Changing Consumption Patterns

- Health Consciousness: Health awareness is leading to a preference for sugar-free or organic chocolates, presenting a challenge to traditional chocolate products.

- Personalized Chocolate Offerings: Consumers are increasingly interested in customized chocolates for special occasions. Companies are responding with bespoke packaging and flavors.

Regional Insights

Western Saudi Arabia:

This region, including Jeddah, Mecca, and Medina, experiences high chocolate demand due to its tourist-heavy population. Chocolates are often purchased as gifts, especially during religious seasons, fueling the market growth.

Northern & Central Saudi Arabia:

Urbanization and rising disposable incomes in the Northern and Central regions are driving chocolate consumption. Local manufacturers and international brands are adapting to the preferences of an increasingly affluent population.

New Publish Reports

- Global Chocolate Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

- United States Chocolate Market Size and Share Analysis – Growth Trends and Forecast Report 2025-2033

- Dark Chocolate Market Global Report by Type (70% Cocoa Dark Chocolate, 75% Cocoa Dark Chocolate, 80% Cocoa Dark Chocolate, and 90% Cocoa Dark Chocolate), Application (Confectionery, Functional Food & Beverage, Pharmaceuticals, and Cosmetics), Distribution Channel (Convenience Stores, Supermarkets and Hypermarkets, Non-Grocery retailers, and Others), Countries and Company Analysis 2025-2033

Competitive Landscape

Some of the key players in the Saudi Arabia chocolate market include:

- Aani & Dani

- Artisan du Chocolat

- Bateel

- Al Nassama

- Bostani Chocolate

The market is also seeing a surge in premium and artisanal chocolate brands, with local companies like Waw Chocolate offering products tailored to regional tastes.

Growth Drivers

- Increasing Chocolate Consumption: The gifting culture during cultural festivals boosts chocolate sales.

- Health-Oriented Products: There is an emerging market for chocolates with health benefits, like dark chocolate, which appeals to health-conscious consumers.

- Premium Products: Consumers are willing to pay more for premium quality chocolates, with demand growing for artisanal chocolates and plant-based options.

Challenges

- Imported Cocoa Dependency: Saudi Arabia faces challenges due to its reliance on imported cocoa and raw materials, which makes the market vulnerable to global price fluctuations and supply chain disruptions.

- Health Trends: The growing demand for healthier chocolate alternatives (sugar-free, organic) requires significant innovation from manufacturers.

Key Questions to Address in the Market Report

- What are the primary drivers behind the growth of the chocolate market in Saudi Arabia?

- How does the cultural importance of festivals affect chocolate consumption patterns in Saudi Arabia?

- What is the role of health trends in shaping consumer preferences for chocolate?

- Which distribution channels are seeing the highest growth in the Saudi Arabian chocolate market?

- How do regional preferences for chocolate differ within Saudi Arabia, particularly in urban and tourist-heavy areas?

- What impact does the increasing trend of premium chocolates have on market dynamics?

- How do international brands compare to local manufacturers in the Saudi chocolate market?

- What innovations are chocolate companies adopting to cater to the growing demand for healthier options?

- How is the ongoing urbanization in Saudi Arabia influencing chocolate consumption trends?

- What are the competitive strategies that key players are employing to increase their market share in the Saudi Arabian chocolate market?

Conclusion and Market Forecast

The Saudi Arabia chocolate market is poised for significant growth, driven by rising disposable incomes, changing consumer preferences, and a growing inclination toward premium and health-conscious products. The ongoing urbanization and the influx of tourists further fuel the demand, creating lucrative opportunities for both local and international chocolate brands.

With a comprehensive understanding of the market segments and regional preferences, stakeholders can make informed decisions to capitalize on the growing chocolate demand in Saudi Arabia.