GCC Financial Cards & Payments Market Outlook 2030 – Emerging Trends, Market Size, Growth Drivers, and Future Forecast

MarkNtel Advisors recently published a detailed industry analysis of the GCC Financial Cards & Payments Market. The report covers growth trends, geographical marketing strategies, challenges, opportunities, and drivers influencing the market.

GCC Financial Cards & Payments Market, Share, and Trends Analysis Report – Industry Overview and Forecast to 2030

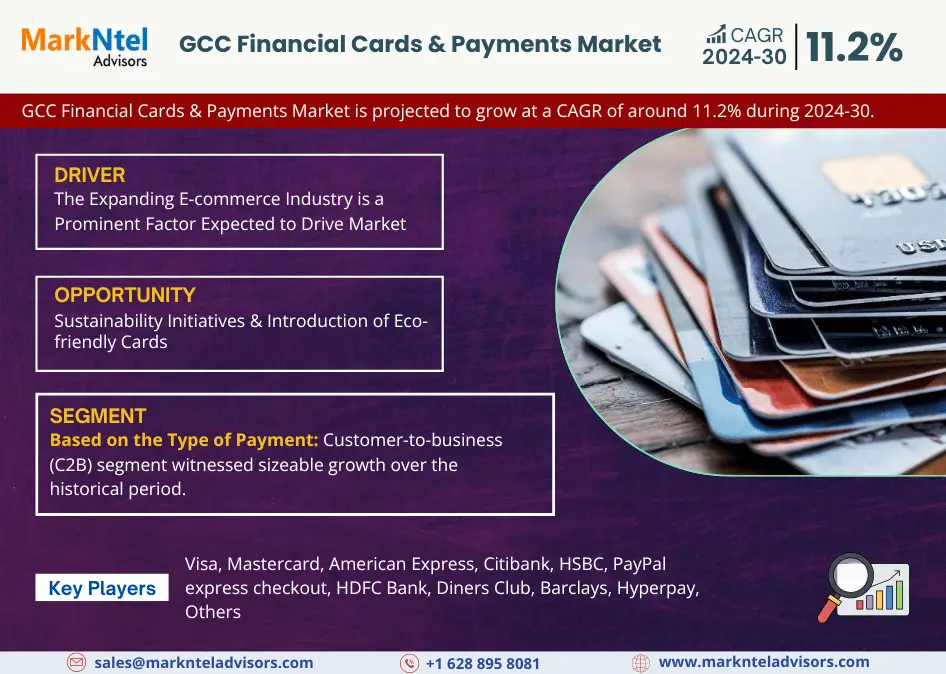

The GCC Financial Cards & Payments Market is projected to grow at a CAGR of around 11.2% during the forecast period, i.e., 2024-30.

What are the major Driver the GCC Financial Cards & Payments industry?

Expanding E-commerce Industry – The growing e-commerce industry across the GCC region has well-supported the Financial Cards & Payments Market over the historical years. The countries, such as the UAE, Saudi Arabia, Qatar, etc., have witnessed a significant surge in online retail sales due to high investments by global retail players in the lucrative market. The countries, including the UAE, Qatar, Kuwait, and Bahrain have almost 100% of the population with internet and mobile phone access.

Due to this, the transactional volume of payments made via financial cards, such as debit cards, prepaid cards, credit cards, etc., has increased considerably. Moreover, the Dubai Chamber of Commerce and Industry forecasts e-commerce to generate USD8 billion in sales by the year 2025. Hence, it is expected that the ever-growing e-commerce market in the region will increase the demand for financial cards and payments in the forecast years.

Access the detailed PDF Sample report –

https://www.marknteladvisors.com/query/request-sample/gcc-financial-cards-payments-market.html

✅In case you missed it, we are currently revising our reports. Click on the below to get the latest research data with forecast for years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

What segments define the GCC Financial Cards & Payments Market from 2024 to 2030? How do these segments contribute to market dynamics and growth?

- By Type of Card

- Credit Card

- Debit Card

- Charge Card

- Prepaid Card

- By Type of Payments

- B2B

- B2C

- C2C

- C2B

- E-Commerce Shopping

- Payments at POS Terminals

- Others

According to report, Customer-to-business (C2B) segment witnessed sizeable growth over the historical period.

- By Type of Transactions

- Domestic

- Foreign

- By Card Issuing Institution

- Banking

- Non-Banking

Explore the Complete GCC Financial Cards & Payments Market Analysis Report –

https://www.marknteladvisors.com/research-library/gcc-financial-cards-payments-market.html

Geographical Analysis: GCC Financial Cards & Payments Market

- By Country

- Saudi Arabia

- The UAE

- Qatar

- Bahrain

- Kuwait

- Oman

GCC Financial Cards & Payments Market Share & Competitive Landscape:

The GCC Financial Cards & Payments Market is characterized by intense competition, with several key players driving growth through innovation, market expansion, and strategic investments. The competitive landscape provides valuable insights into the industry’s leading companies, highlighting their strengths, financial performance, and market influence.

Leading Companies in the GCC Financial Cards & Payments Market are:

- Visa

- Mastercard

- American Express

- Citibank

- HSBC

- PayPal express checkout

- HDFC Bank

- Diners Club

- Barclays

- Hyperpay

Questions Addressed in this Study

1.What factors are driving the GCC Financial Cards & Payments Market growth?

2.How is the GCC Financial Cards & Payments Market expected to grow over the next five years?

3.What are the key insights into the current trends in the GCC Financial Cards & Payments Market ?

4.What is the current size of the GCC Financial Cards & Payments Market, and how is it projected to change in the future?

6.What is the future outlook for the GCC Financial Cards & Payments Market in terms of technological advancements and market expansion?

For a Customized Analysis Report, Just Drop Your Inquiry Here –

Why MarkNtel Advisors?

MarkNtel Advisors is a leading research, consulting, & data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, & individuals, among others.

Our specialization in niche industries informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, & trend analysis, among others, for 15 diverse industrial verticals.

More Research Studies Report:

–Biocomposites Market size was valued at around USD 36.9 billion in 2024 and is projected to reach USD 89 billion by 2030 with a CAGR of around 16%.

–Green Solvents Market size was valued at around USD 1.34 billion in 2024 & is projected to reach USD 1.87 billion by 2030 with a CAGR of around 5.7%.

For Media Inquiries, Please Contact:

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India