The Comprehensive Guide to Oracle Accounting System

In the ever-evolving world of business, managing financial data efficiently is crucial for the success of any organization. With the increasing complexity of financial transactions and the need for real-time reporting, companies are turning to advanced accounting systems to streamline their operations. One such system that has gained significant traction in the corporate world is the Oracle Accounting System. This article delves into the intricacies of the oracle accounting system, exploring its features, benefits, and why it stands out as a preferred choice for businesses worldwide.

What is the Oracle Accounting System?

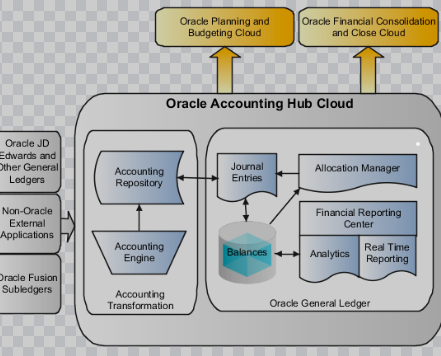

The Oracle Accounting System is a robust financial management solution designed to help organizations manage their financial operations with precision and ease. Developed by Oracle Corporation, a global leader in enterprise software, this system integrates various financial processes into a single platform, enabling businesses to automate and optimize their accounting functions. From general ledger management to accounts payable and receivable, the Oracle Accounting System offers a comprehensive suite of tools that cater to the diverse needs of modern enterprises.

Key Features of the Oracle Accounting System

One of the standout features of the Oracle Accounting System is its ability to provide real-time financial insights. In today’s fast-paced business environment, having access to up-to-date financial data is essential for making informed decisions. The system’s real-time reporting capabilities allow businesses to monitor their financial health continuously, identify trends, and respond to changes promptly. This level of visibility is particularly beneficial for large organizations with complex financial structures, as it enables them to maintain control over their finances and ensure compliance with regulatory requirements.

Another notable feature of the Oracle Accounting System is its scalability. Whether you’re a small business or a multinational corporation, the system can be tailored to meet your specific needs. As your business grows, the Oracle Accounting System can scale accordingly, accommodating increased transaction volumes and additional users without compromising performance. This scalability ensures that the system remains a valuable asset throughout your organization’s lifecycle, providing consistent support as your financial operations evolve.

The Oracle Accounting System also excels in its integration capabilities. In today’s interconnected business landscape, seamless integration between different systems is crucial for maintaining operational efficiency. The Oracle Accounting System can be easily integrated with other Oracle applications, such as Oracle ERP Cloud and Oracle Supply Chain Management, as well as third-party systems. This integration eliminates data silos, ensuring that financial information flows smoothly across the organization. As a result, businesses can achieve greater accuracy in their financial reporting and reduce the risk of errors caused by manual data entry.

Benefits of Using the Oracle Accounting System

Implementing the Oracle Accounting System offers numerous benefits that can significantly enhance your organization’s financial management processes. One of the primary advantages is improved efficiency. By automating routine accounting tasks, such as journal entries, invoice processing, and reconciliation, the system frees up valuable time for your finance team. This allows them to focus on more strategic activities, such as financial analysis and planning, which can drive business growth.

Another key benefit of the Oracle Accounting System is enhanced accuracy. Manual accounting processes are prone to errors, which can lead to costly mistakes and compliance issues. The system’s automation capabilities minimize the risk of human error, ensuring that your financial data is accurate and reliable. Additionally, the system’s built-in validation rules and audit trails provide an extra layer of security, helping you maintain the integrity of your financial records.

The Oracle Accounting System also offers superior financial control. With its centralized platform, you can manage all your financial operations from a single interface, giving you a holistic view of your organization’s financial performance. This centralized approach simplifies financial management, making it easier to monitor cash flow, track expenses, and manage budgets. Furthermore, the system’s advanced reporting tools enable you to generate detailed financial reports, providing valuable insights that can inform your decision-making process.

Compliance is another area where the Oracle Accounting System shines. The system is designed to comply with international accounting standards, such as Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). This compliance ensures that your financial statements are prepared in accordance with regulatory requirements, reducing the risk of non-compliance and potential penalties. Additionally, the system’s robust security features protect your financial data from unauthorized access, ensuring that your sensitive information remains secure.

Why Choose the Oracle Accounting System?

With so many accounting systems available in the market, you might wonder what sets the Oracle Accounting System apart. One of the key differentiators is Oracle’s reputation for innovation and reliability. As a leading provider of enterprise software, Oracle has a proven track record of delivering high-quality solutions that meet the needs of businesses across various industries. The Oracle Accounting System is no exception, offering a powerful and reliable platform that can handle the most demanding financial operations.

Another reason to choose the Oracle Accounting System is its user-friendly interface. Despite its advanced capabilities, the system is designed to be intuitive and easy to use. This user-friendliness ensures that your finance team can quickly adapt to the system, minimizing the learning curve and maximizing productivity. Additionally, Oracle provides comprehensive training and support resources, ensuring that your team has the knowledge and tools they need to make the most of the system.

The Oracle Accounting System also offers a high degree of customization. Every business is unique, and the system’s flexible architecture allows you to tailor it to your specific requirements. Whether you need to customize financial reports, configure workflows, or set up user permissions, the system provides the flexibility to adapt to your organization’s needs. This customization ensures that the system aligns with your business processes, enhancing its effectiveness and delivering greater value.

Conclusion

In conclusion, the Oracle Accounting System is a powerful financial management solution that offers a wide range of features and benefits designed to streamline your accounting processes. From real-time financial insights and scalability to enhanced accuracy and compliance, the system provides the tools you need to manage your finances effectively. Its integration capabilities, user-friendly interface, and customization options further enhance its appeal, making it a preferred choice for businesses of all sizes.

As the business landscape continues to evolve, having a reliable and efficient accounting system is more important than ever. The oracle accounting system not only meets this need but also provides a platform for future growth and innovation. By investing in the Oracle Accounting System, you can ensure that your organization is well-equipped to navigate the complexities of modern financial management and achieve long-term success.